Contents:

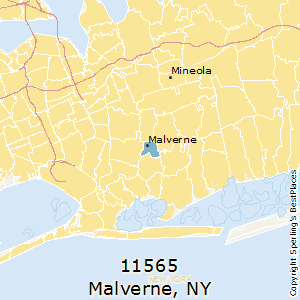

It also has regional offices in the cities of New Delhi, Kolkata, Chennai, and Ahmedabad, and more than a dozen local offices in cities including Bangalore, Jaipur, Guwahati, Patna, Kochi, and Chandigarh. The Securities and Exchange Board of India is the leading regulator securities markets in India, analogous to the Securities and Exchange Commission in the U.S. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models.

The price of ETF units moves in line with the price of gold on metal exchange. TER of FoF investing in other schemes than mentioned above has been capped @2%. An ETF is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Investors have the comfort of knowing the stocks that will form part of the portfolio, since the composition of the index is known. – Index funds are passively managed, which means that the fund manager makes only minor, periodic adjustments to keep the fund in line with its index. Hence, Index fund offers the same return and risk represented by the index it tracks.

Origin of SEBI

The Regional Office will handle work as per existing delegation and shall continue to report to functional heads for specific departmental functions while reporting administratively to SEBI Executive Directors. The Legal Affairs Department 2 is responsible for all the litigations wherein SEBI is a party (except appeals before the Hon’ble Securities Appellate Tribunal and criminal/prosecution matters). Presently, there are three divisions in LAD2 that handle the functions of the Department. The Human Resources Division will perform all the functions in its role as the principal personnel and human resources authority in SEBI. 10 billion can apply to SEBI for voluntary surrender of recognition and exit, at any time before the expiry of two years from the date of issuance of this Circular.

The Department of Debt and Hybrid Securities is responsibe for matters related to Corporate Bonds, listed debt securities, Real Estate Investment Trust, Infrastructure Investment Trust, deemed public issues of debt securities and complaints in respect of aforementioned areas of work. The Indian Securities market regulator SEBI had given the recognized Securities exchanges two years to comply or exit the business. Further, it came into light that Dr. K. M. Abraham had written to the Prime Minister about malaise in SEBI. He said, “The regulatory institution is under duress and under severe attack from powerful corporate interests operating concertedly to undermine SEBI”.

Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. SEBI has also been instrumental in taking quick and effective steps in light of the global meltdown and the Satyam fiasco. In October 2011, it increased the extent and quantity of disclosures to be made by Indian corporate promoters. In light of the global meltdown, it liberalised the takeover code to facilitate investments by removing regulatory structures.

Sebi moots promoter tag for founders holding 10% – The Financial Express

Sebi moots promoter tag for founders holding 10%.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

The recommendations relate to improvement of practices, policies, procedures and disclosures by encouraging asset managers to take sustainability related risks and opportunities into account in their investment decision-making and risk management processes. While such standards are yet to emerge, in the meanwhile, there is a need to introduce disclosure norms for domestic ESG Mutual Fund schemes considering the increased activity in this area. It is understood that these disclosure norms would further evolve and undergo changes based on learnings and experience, both on the domestic and international front.

Hence, Arbitrage funds are considered to be a good choice for cautious investors who want to benefit from a volatile market without taking on too much risk. The regular income earned from the debt instruments provide greater stability to the returns from such funds. They seek to find a ‘balance’ between growth and income by investing in both equity and debt. The regulator earlier revised the definition of green debt security within which transition bonds are the funds raised for transitioning to a more sustainable form of operations. The markets regulator has asked companies to identify interim targets like by how much they plan to reduce the emissions, project implementation strategy, technology for implementation, and the mechanism to oversee the utilisation of the funds raised through transition bonds. The Securities and Exchange Board of India has prescribed additional disclosures for issuance of transition bonds, a sub-category of green debt securities, to check misallocation.

The Issuer Company / Merchant Bankers shall ensure that the disclosures in the abridged prospectus are adequate, accurate and does not contain any misleading or mis-statement. In order to further simplify, provide greater clarity and consistency in the disclosures across various documents and to provide additional but critical information in the abridged prospectus, the format for disclosures in the abridged prospectus has been revised and is placed at Annexure A of this Circular. Clarification of a pecuniary relationship or transaction by specifying certain relationships and transactions that would impact independence of an ID Cooling off period for a material pecuniary relationship between the relative and the related entities extended to three years. This threshold of Rs 1,000 crore has been included on account of the fact that certain high value transactions may not get covered under the 10% threshold for materiality.

Equity funds may focus on certain sectors of the market or may have a specific investment style, such as investing in value or growth stocks. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Debt-oriented hybrid funds are suitable for conservative investors looking for a boost in returns with a small exposure to equity. FMPs, being closed-end schemes are mandatorily listed – investors can buy or sell units of FMPs only on the stock exchange after the NFO. Short term debt funds have to also be evaluated for the credit risk they may take to earn higher coupon income.

Qualified Institutional Buyers can sell off large chunks of stock and exit at any point in time. This is in sharp contrast with investing in an IPO, where a 1-year lock-in period exists. Unlike traditional methods of raking up investments which takes time and requires SEBI’s approval, a QIP can be settled quickly, sometimes in a week’s time.

Equity Linked Savings Scheme (ELSS)

Still, SEBI has been aggressive at times in doling out punishment and in issuing strong reforms. It also established the Financial Stability Board in 2009, in response to the global financial crisis, giving the board a broader mandate than its predecessor to promote financial stability. The SEBI headquarters is located in the business district at the Bandra-Kurla Complex in Mumbai.

- It also has regional offices in the cities of New Delhi, Kolkata, Chennai, and Ahmedabad, and more than a dozen local offices in cities including Bangalore, Jaipur, Guwahati, Patna, Kochi, and Chandigarh.

- Pay 20% upfront margin of the transaction value to trade in cash market segment.

- Sectoral funds invest in a particular sector of the economy such as infrastructure, banking, technology or pharmaceuticals etc.

- He said, “The regulatory institution is under duress and under severe attack from powerful corporate interests operating concertedly to undermine SEBI”.

- Supreme Court of India heard a Public Interest Litigation filed by India Rejuvenation Initiative that had challenged the procedure for key appointments adopted by Govt of India.

It became an autonomous body on 30 January 1992 and was accorded statutory powers with the passing of the SEBI Act 1992 by the Parliament of India. SEBI has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively. It has opened local offices at Jaipur and Bangalore and has also opened offices at Guwahati, Bhubaneshwar, Patna, Kochi and Chandigarh in Financial Year 2013–2014. The Dodd-Frank Wall Street Reform and Consumer Protection Act is a series of federal regulations passed to prevent future financial crises.

Sebi prescribes additional disclosures for issuing transition bonds

ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. The headquarters of Securities and Exchange Board of India is in the heart of Mumbai , the finance capital of India. The SEBI also has its branch offices located in Ahmedabad, Chennai, Kolkata, New Delhi to serve western, southern, eastern, and northern regions of the country respectively. For every stock market across the world, there is a watchdog which keeps a close eye on the market activities to ensure that the interests of every participant are not impacted by frivolous activities of any other participants. In India, SEBI has been created to ensure that the market activities are free and fair.

Foreign investors to seek review of enhanced Indian rules after … – Reuters India

Foreign investors to seek review of enhanced Indian rules after ….

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

The SEBI Act,1992 provides for the establishment of a Board to protect the interests of investors in securities and to promote the development of, and to regulate, the securities market and for matters connected therewith or incidental thereto. For detailed regulations and guidelines on markets, mutual funds and SIPs, investors can visit the official website of SEBI, Prior approval of the audit committee of the listed entity shall not be required for a related party transaction to which the listed subsidiary is a party but the listed entity is not a party, if regulation 23 and sub-regulation of regulation 15 of these regulations are applicable to such listed subsidiary. The SEBI has directed the Asset Management Companies of mutual funds to constitute an Audit Committee w.e.f. August 1, 2022.

The Office will support SEBI’s operation by handling investor complaints centrally and be the focal point of SEBI’s investor education effort.The Office would be the single point interface with investors and would receive complaints relating to all departments, forward to the concerned departments. The Market Intermediaries Regulation and Supervision Department is responsible for the registration, supervision, compliance monitoring and inspections of all market intermediaries in respect of all segments of the markets viz. Equity, equity derivatives, currency derivatives, debt and debt related derivatives. The Recovery and Refund Department deals with recovery proceedings against the defaulters who have failed to pay the penalty, fees, disgorgement amount or monies directed to be refunded to investors and refund of such monies.

Short-Term Debt Funds

A competent merchant broker can place a QIB’s investment corpus into a distressed firm’s coffers and revive it quickly. Are placed multiple times, a minimum gap of 6 months between 2 placements is mandatory. The Stock Exchange may ask for reports and undertakings for such transactions. However, in the case of QIPs and preferential allotments, it is not mandatory to submit any such reports. Qualified Institutional Buyers possess considerable financial heft, with exchange boards recognising them as legal entities. These third-party institutions possess the necessary market experience and knowledge to ensure better returns.

- “KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.”

- It supplanted the Controller of Capital Issues, which had regulated the securities markets under the Capital Issues Act of 1947, passed just months before India gained independence from the British.

- Hence, Arbitrage funds are considered to be a good choice for cautious investors who want to benefit from a volatile market without taking on too much risk.

- Still, SEBI has been aggressive at times in doling out punishment and in issuing strong reforms.

Wall Street is in lower Manhattan and is home to the New York sebi definition Exchange . Federal Reserve regulations are rules put in place by the Federal Reserve Board to regulate the practices of banking and lending institutions, usually in response to laws enacted by the Congress. SEBI has wide-ranging regulatory, investigative, and enforcement powers, including the ability to impose fines on violators. Guidelines which were formulated in 2000 and amended, SEBI designates the following as QIBs.

SEBI has also opened local offices in Jaipur, Bangalore, Guwahati, Bhubaneswar, Patna, Kochi and Chandigarh. Equity oriented hybrid funds are ideal for investors looking for growth in their investment with some stability. A portion of the amount brought in by the investors is invested in debt instruments that is expected to mature to the par value of the capital invested by investors into the fund. With the increased interest and focus on investments in the Environment Sustainability and Governance space globally, Asset Management Companies in India have also been launching equity schemes in the ESG space under thematic category. The AMCs are also launching Exchange Traded Funds and ETF Fund of Funds in India in ESG space. Globally, the concept of ESG investments is still emerging and there are no universally agreed norms and standards.

The Audit Committee of the AMC shall be responsible for oversight of financial reporting process, audit process, company’s system of internal controls, compliance to laws and regulations and other related process, with specific reference to operation of its Mutual Fund business. The format has been prescribed by SEBI to ensure consistency in RPT disclosures, being made to the stock exchanges, across listed entities. Listed entities to submit letter of resignation of resigning ID to stock exchanges and also disclose names of listed entities in which the resigning director holds directorships, indicating the category of directorship and membership of board committees, if any. Gold ETFs are treated as non-equity oriented mutual funds for the purpose of taxation. Fund of funds are mutual fund schemes that invest in the units of other schemes of the same mutual fund or other mutual funds. Unlike regular mutual funds, an ETF trades like a common stock on a stock exchange.

NRC may use services of external agency, to identify suitable candidates, if required. Shareholders’ approval of omnibus RPTs approved in an AGM shall be valid upto the date of the next AGM for a period not exceeding fifteen months. Pay 20% upfront margin of the transaction value to trade in cash market segment. Please ensure you carefully read the risk Disclosure Document as prescribed by SEBI. Please ensure you carefully read the risk Disclosure Document as prescribed by SEBI/FMC.

India’s SEBI allows govt stake in IDBI Bank to be reclassified as … – Reuters

India’s SEBI allows govt stake in IDBI Bank to be reclassified as ….

Posted: Thu, 05 Jan 2023 08:00:00 GMT [source]

In a circular dated May 4, Sebi also recommended issuers to form a committee to oversee the implementation and ensure timely completion of the defined targets. This Circular shall be applicable for all issues opening after the date of this Circular. While the disclosures in the abridged prospectus shall be as per Annexure A of this Circular instead of Annexure I of Part E of Schedule VI of ICDR Regulations, the disclosure on front outside cover page shall be as per Annexure B of this Circular. A copy of the abridged prospectus shall be made available on the website of issuer company, lead managers, registrar to an issuers and a link for downloading abridged prospectus shall be provided in price band advertisement.

Since these funds focus on just one sector of the economy, they limit diversification, and are thus riskier. Furthermore, the Issuer Company/MBs shall ensure that the qualitative statements in the abridged prospectus shall be substantiated with Key Performance Indicators and other quantitative factors. Also, no qualitative statement shall be made which cannot be substantiated with KPIs. Section 2 of the Companies Act,2013(“Companies Act”) defines an abridged prospectus as a memorandum containing such salient features of a prospectus as may be specified by the Securities and Exchange Board India by making regulations in this behalf.